Coalition Launches Native American Veterans Homeownership Needs Assessment

We are excited to announce that the Coalition has partnered with Big Water Consulting and NeighborWorks to launch a statewide study to better understand the current housing conditions and needs of Native American veterans living on South Dakota’s nine Indian reservations.

“The findings of this study will support the Coalition as we continue to increase access to homeownership resources for Native American veterans. It will also paint an accurate picture in our national policy discussions, ensuring federal programming aligns with the true needs of Native veterans,” says Cheryce Not Afraid, Director of the Coalition.

The first wave of the study begins today with surveys on the Cheyenne River, Crow Creek, Pine Ridge, and Rosebud Reservations. Second and third waves will begin in December and next spring, respectively, and will cover the remaining reservations throughout the state. The survey will capture general demographic information as well as more specific information regarding the respondent’s current housing situation, housing preferences, and housing challenges.

“We are putting out a call to all Cheyenne River, Crow Creek, Oglala, and Rosebud veterans to get in touch with us and answer the survey now. We’re also asking Flandreau, Lower Brule, Sisseton, Standing Rock, and Yankton vets to remain on stand-by, as their information will be critical in the coming months,” says Kimberly Long Soldier, the Coalition’s Homeownership Program Manager.

An online version of the survey can be accessed here. Veterans who wish to complete a paper survey can get in touch with a representative from their area.

Cheyenne River

Robert Dunsmore

(605) 200-9012

Michelle Running Wolf

(605) 964-4265

Crow Creek

Kay Koster

(605) 245-2059

Joe Shields

(605) 245-2250

Pine Ridge

Kimberly Long Soldier

(605) 455-2500

Rosebud

Monica Hunger Moran

(605) 747-2203

Orlando Morrison

(605) 747-2593

Coalition Programs Expand Career Opportunities

Five years ago, David Spider (Sisseton Wahpeton Oyate) attended one of the South Dakota Native Homeownership Coalition’s first inspector certification trainings. During this training he was introduced to the International Code Council building requirements. After completing a couple more trainings, he successfully passed the 60-question test within the allotted three-hour time limit and became a certified residential building inspector. An employee of the Sisseton Wahpeton Housing Authority, David’s certification immediately and directly benefited his tribal community.

“Since then, I have been able to inspect new housing projects, and we’ve had 57 homes completed over the last five years,” says David.

By having a local certified inspector, construction projects are able to be completed at a faster pace and with the assurance that the structures are safe and durable. A certified inspection is a requirement put in place by many lenders that finance the construction or purchase of residential homes. David says a lot of the inspections he does are for HUD 184 construction loans. He also does inspections for existing homes purchased by tribal members or any homes purchased with the new Sisseton Wahpeton Oyate Down Payment Assistance Program.

In addition, David’s certification has opened more funding opportunities for his tribe’s housing projects. Having that additional qualification on their team makes their grant proposals more competitive.

“We are able to get almost perfect scores in the administrative category on our HUD grants due to the capacity of our team,” says David.

While the inspector certification exam is certainly challenging, David believes his engineering background and bachelor’s degree in civil engineering helped a lot. Because it is an open book test, the key is being able to flip through the book quickly. A solid understanding of the basic concepts and the ability to find topics through the table of contents and index is also a must.

David’s next career enhancing endeavor is becoming a certified general appraiser. Also part of the Coalition’s programming, the appraiser initiative aims to increase the number of appraisers that serve tribal communities throughout the state. So far, David has completed a beginning class and is planning to take several more. Once the class level is complete, he will apprentice with a certified appraiser for 1,800 hours. During that time, he will learn more and more about the job until he is ready to do it on his own. Eventually, he will achieve his own certification.

“I’ll gradually work up to becoming independent within three to five years,” says David.

Coalition Receives $1.7 Million Grant, Kicks Off New Statewide Down Payment Assistance Program

During the South Dakota Native Homeownership Coalition’s first-ever Annual Membership Meeting, the Wells Fargo Foundation announced a $1.7 million grant award from its Invest Native initiative to support the Coalition’s continued growth and development, including creating a new housing development subsidiary to support tribal communities in their efforts to increase the number of safe and affordable homes.

“As the Bank of Doing, our goal is to work alongside Native communities and continue a dialogue around how we can best support local leaders and their work,” stated Otis Rolley, president of the Wells Fargo Foundation. “The collaborative approach of the South Dakota Native Homeownership Coalition is highly effective in creating more access to resources and empowering more Native homeowners.”

This grant is part of Invest Native, a $20 million philanthropic initiative by Wells Fargo to strengthen housing access and affordability, small business growth and sustainability in Native communities across six states.

“We are grateful to Wells Fargo for investing in statewide coalitions like ours that bring together partners who develop innovative strategies to help Native families overcome the barriers associated with homeownership in Indian Country,” said Cheryce Not Afraid, Director of the Coalition.

At today’s meeting, the Coalition also announced its new down payment assistance program designed to increase home affordability for South Dakota’s Native American families and close the state’s racial homeownership gap, which currently lies at 35.7%. The program, which was supported by previously awarded funding from Wells Fargo and the Northwest Area Foundation, will infuse $500,000 of down payment funds into South Dakota’s Native communities, resulting in at least 50 new Native homeowners.

Also of significance during the Coalition’s Annual Membership Meeting, U.S. Senator Mike Rounds (R-SD) provided an update on several pieces of federal legislation he is advancing to support increased rates of Native American homeownership, including efforts to reform the U.S. Department of Veterans Affairs Native American Direct Loan, to expand the U.S. Department of Agriculture 502 home loan relending demonstration, and to streamline the Bureau of Indian Affairs mortgage approval process.

“The Coalition has achieved some critical milestones today,” said Sharon Vogel, Coalition Chairwoman and Executive Director of the Cheyenne River Housing Authority. “Throughout our ten-year history, we’ve strived to make it easier to achieve homeownership. Since 2016, Coalition members have supported 253 Native families to become homeowners. As we expand our programming and continue to remove federal policy impediments, that number will only get higher.”

Introducing Tanisha!

Let’s welcome Tanisha Swanson to the Coalition’s team! Tanisha joined our staff as Program Coordinator in July.

In her position as Program Coordinator, Tanisha will be helping to manage the Administration for Native Americans (ANA) Social and Economic Development grant project, which is designed to transition the Coalition into an independent non-profit organization. Since coming on board, she has been providing administrative support to our Board of Directors and working committees, as well as helping with the logistics of our upcoming Annual Membership Meeting & Planning Day. Tanisha will also be responsible for coordinating the Coalition’s impact tracking and data reporting efforts.

Prior to joining the our team, Tanisha was an Occupancy Specialist at Crow Creek Housing Authority. She was a Gates Millennium Scholar and studied psychology at South Dakota State University and Sinte Gleska. Tanisha has four children and currently lives in Sisseton.

“It’s exciting to be a part of the Coalition in this stage of its development when there is so much innovation happening. I’m looking forward to contributing to the organization’s growth and increased homeownership for Native families,” says Tanisha.

Coalition Member Recognized on National Stage

Stephanie Provost received the Industry Achiever Award from Oweesta Corporation.

On Wednesday, June 28th, during their 2023 Native CDFI Capital Access Convening’s Native Awards Night, Oweesta Corporation recognized two individuals at the Native CDFI staff level for their outstanding commitment to service in Native CDFI industry. One of the awardees was Stephanie Provost of Mazaska Owecaso Otipi Financial, a long-time Coalition member.

Oweesta awarded the Industry Achiever Award to Stephanie because she exemplifies excellence in the Native CDFI industry, excells at her position within Mazaska, and helps the organization meet their mission. As Loan Officer of Mazaska, Stephane plays a crucial role in creating affordable housing opportunities. Her dedication and passion have allowed Mazaska to provide over $4.8M in housing loans to 43 borrowers in just six years.

The Coalition would like to congratulate Stephanie, not only for her commitment to Mazaska, but also for all the contributions she makes within the Native homeownership field. She has helped innovate lending models to make the Native American Direct Loan (NADL) more accessible and has been an integral part of the USDA 502 Relending Demonstration Program. Stephanie recently went to the Hill to advocate for policies that promote Native homeownership, and recently became a homeowner herself. This award acknowledges Stephanie’s passion and hard work for the industry and people she has helped to make homeownership a reality.

Welcome Kimberly!

Kimberly Long Soldier joined the Coalition’s staff as our Homeownership Program Manager in May. We are glad she is on board!

Growing up in Kyle, South Dakota, Kimberly joined the military at 17 years old. During her time in the Army, she was stationed at various locations throughout the globe and served as a Military Policeman. Kimberly holds an Associate’s and Bachelor’s degree in Human Services, and has several years of experience in case management and directing nonprofit programs with a focus on homelessness, job connection services, and veterans.

In her position as Homeownership Program Manager, Kimberly is managing the Wells Fargo Wealth Opportunities Restored Through Homeownership (WORTH) grant, which was awarded in partnership with cdcb, Fahe, Communities Unlimited, HOPE, RCAC, and Oweesta, collectively known as Partners for Rural Transformation. The grant project will create 5,000 new BIPOC homeowners over the next four years, and 400 of them will be located in South Dakota. Since she has come on board, Kimberly has been focusing heavily on developing the Coalition’s new down payment assistance program, which will be launching soon. The program will work with Coalition member organizations to deploy up to $10,000 in down payment funds to tribal members who are purchasing homes, making homeownership more affordable for Native American families.

“I’m really looking forward to helping people. I know how hard it can be to purchase a home because of the land issues, jobs, and housing availability. But, the Coalition is helping people overcome those barriers, and I’m excited to have the opportunity to see that,” says Kimberly.

Introducing Our Workforce Development Team!

Samantha McGrath and Justin Williams have joined the Coalition’s growing team and will be focusing on our workforce development program. Let’s give them a warm welcome!

Last year, the Coalition was awarded a $5 million grant by the U.S. Economic Development Administration for a project that will support the creation of 100 jobs over a three-year period. The project builds on our capacity-building work in the residential construction industry, specifically through our construction internship program, contractor trainings, appraiser and inspector certifications, and partnerships with colleges and universities.

As the Workforce Development Program Manager, Samantha is helping with program design, overseeing grant activities, and building relationships within the residential construction field. She comes to the Coalition from Elevate Rapid City where she facilitated the workforce development program for three years. She has extensive experience in apprenticeship and labor programming, as well as the federal grants system. Samantha holds a degree in Business Management from the University of Phoenix.

She is glad to be a part of the Coalition’s mission to create homeownership opportunities and says, “To deploy such a holistic approach, with wrap-around services, to the complex issue of homeownership on reservations in South Dakota is something that has never been done before, it’s a very exciting program to be a part of.”

In his role as Workforce Development Training Coordinator, Justin is actively coordinating training events, supporting the delivery of wrap-around services, and coordinating data tracking efforts. In addition, he is responsible for recruiting individuals for the construction internship program, contractors for contractors’ capacity building trainings, as well as individuals for inspector trainings. Prior to this role, he was the Assistant Registrar in the Administration Office at Oglala Lakota College. Justin grew up in Oglala, South Dakota, and received his degree in Information Technology from Oglala Lakota College in 2021.

He says, “The Coalition is doing some great things for the reservations in South Dakota, and being part of it is an award in itself. I’ve always liked helping people, and the Coalition is making that happen by giving individuals great opportunities ranging from the construction internship to homeownership.”

Getting to Know Lakota Funds

Elmer Clairmont and Agnes High Horse purchased their rental home in the Eagle Nest Housing Development, a low-income housing tax credit project initiated by Lakota Funds over 20 years ago.

One of the First

Established in 1986 as the first Native American community development financial institution (CDFI), Lakota Funds began by helping entrepreneurs on the Pine Ridge Reservation realize their dreams through $500 loans. Today, Lakota Funds continues to play a vital role in improving life for the Lakota people by placing capital with new and growing businesses on the Pine Ridge and Rosebud Reservations and surrounding areas. Since their inception, they have deployed over 1,419 loans totaling over $24.2 million, helped establish or expand 983 businesses, and created 2,348 permanent jobs. With lending at the heart of their mission, Lakota Funds provides business and agricultural loans up to $300,000.

In addition to being the first-ever CDFI on an Indian Reservation, Lakota Funds has achieved several more historic milestones, including:

- The launch of a child development account program, a unique matched savings program for youth as young as Kindergarten-age, designed to build the family core – the first of its kind on any reservation in the nation.

- Becoming the first Native CDFI to be approved as an FSA guaranteed lender.

The conversion of Eagle Nest Housing, a low-income tax credit housing development, into privately-owned homes. Not only was Eagle Nest the first Native American tax credit financed low-income housing project in America, but it was also the largest-ever influx of residential housing units on deeded land into the Pine Ridge Reservation real estate market.

Partnering to Create Homeownership Opportunities

Another history-making first came through an initiative spearheaded by Lakota Funds to create the Lakota Federal Credit Union. When the Credit Union opened its doors in 2012, it became the first federally-insured financial institution on the Pine Ridge Reservation since 1935. It remains as the only depository institution on the Reservation. Over 10 years later, Lakota Funds and the Lakota Federal Credit Union continue to work collaboratively to leverage resources and expand services to the communities they serve. One aspect of that partnership has directly supported increased homeownership rates for Native American families since the Lakota Federal Credit Union began offering mortgages in 2021. If applicants do not immediately qualify, they are able to engage in Lakota Funds’ credit builder program. After completing the credit builder program, they become mortgage-ready and then re-engage with Lakota Federal Credit Union.

Supporting the Local Construction Industry

Long before that partnership, Lakota Funds was supporting homeownership in other ways. In 2012, Lakota Funds deepened its work with building contractors by offering specialized contractor development services for this critical sector of the Reservation’s economy. Over the next couple of years, Lakota Funds continued to focus on the construction industry by developing and delivering a range of in-person and online courses to build the capacity of this sector. The lending products and development services that Lakota Funds provides, continue to support local building contractors today.

Building a Housing System

With extensive experience in this area, it was a natural fit for Lakota Funds’ Executive Director, Tawney Brunsch, to get involved with the South Dakota Native Homeownership Coalition’s Physical Issues Committee. As Chair of the Committee since it was formed, Tawney has led the group to identify several barriers to the lack of housing stock on South Dakota’s reservations.

“It’s not just a house, it’s about creating a system,” she explains.

By establishing a construction industry capacity building initiative, the group is working on several fronts to build infrastructure and systems that create more opportunities for homeownership. Through robust and holistic programming, the Physical Issues Committee has launched the construction internship program, inspector certification trainings, contractor workshops and trainings, and appraiser apprenticeship opportunities.

Tawney ascertains these efforts with the Coalition have helped strengthen Lakota Funds’ work with building contractors. By partnering on and participating in the construction internship and contractor workshops, it has enabled Lakota Funds to increase direct interactions with contractors and communities.

“It has put is in a good position to help more contractors and advance the types of products we offer to meet their needs,” she says.

Lakota Funds’ Deputy Director, Ellen White Thunder, has also taken an active role in the Physical Issues Committee, becoming a certified residential building inspector herself. Although known for being an extremely difficult test, the pass rate at the last inspector certification training doubled under Ellen’s leadership.

Advocating Homeownership Opportunities

Tawney says that with Lakota Funds serving as the fiscal sponsor for the South Dakota Native Homeownership Coalition, it means “we are going to be right out there in the lead making it happen.”

She points out that the Coalition has identified issues that are impacting all of Indian Country, such as the USDA Rural Development 502 Direct Loan and the US Department of Veterans Affairs Native American Direct Loan. The advocacy work by Coalition members has made substantial changes to both of these programs, leading to increased access to mortgage capital for Native American families.

“We are creating models with the potential to be replicated and scaled, and it’s going well beyond South Dakota. These issues are very near and dear to me, and it’s exciting to be a part of it,” states Tawney.

Getting to Know Eric Shepherd

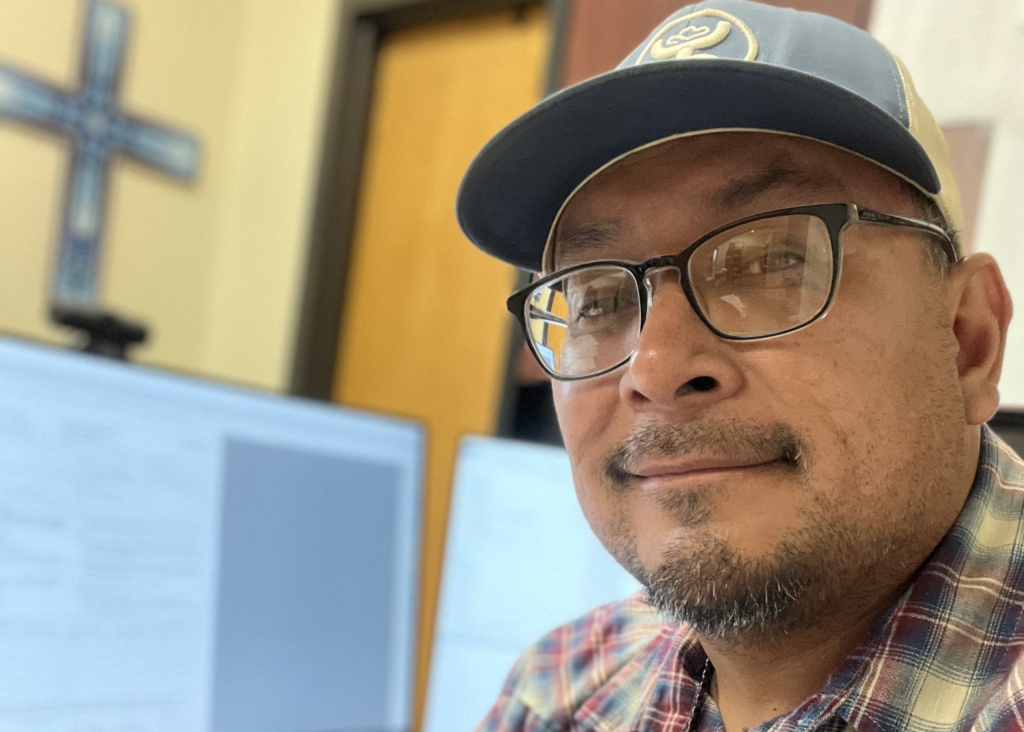

Eric Shepherd, Vice Chairman

Eric Shepherd (third from right) was seated on the South Dakota Native Homeownership Coalition’s inaugural Board of Directors in June 2022. He serves as the Vice Chairman and is the Executive Director of Sisseton Wahpeton Housing Authority.

A New Vision

Eric took the helm of the Sisseton Wahpeton Housing Authority as Executive Director in August of 2018 and has been working to transform the traditional housing authority paradigm in his community since then. Stepping into this position at a time when most tribal homes are nearing the end of their life span, he saw a need for revitalization – not only for the physical structures, but also for the vision of the organization.

“Materials have changed over the years. Our ancestors had to make do with what they had, and that worked for them at that time. We acknowledge those efforts and know that everything we have now is because of what they did. Today, we carry on that legacy by assessing and reevaluating and keep improving,” says Eric.

In less than five years under his leadership, with a commitment from tribal council to support new housing construction, SWHA his built 57 new homes. Rather than building homes to last the standard 20-30 years, they are taking a 50-year approach to embed resiliency into the physical infrastructure of their community. To support this strategy, Eric says his team’s motto is “built tight and ventilated right.” Under the Tribe’s development plan, SWHA will be building several scattered sites over the next 10 years.

Developing a Workforce

These accomplishments have not come without challenges, though. There is a huge age gap in the Sisseton area’s skilled labor force, which strains the efficiencies and productivity levels of SWHA’s construction teams.

“We had an awesome workforce back in the day,” says Eric. He explains that as Indian gaming gained momentum, more tribal members sought out those jobs. As a result, the trades workforce shrank.

While the majority of SWHA’s labor is over 50 years of age, there is a small but growing trend of 20-somethings entering the building trades. This is partially due to SWHA’s involvement in the South Dakota Native Homeownership Coalition’s Construction Internship Program. Through that program, about 20 young tribal members have gained hands-on experience in residential home building and about 10 have obtained full-time employment in the construction sector. With workforce development as one of SWHA’s top priorities, they have approached this issue holistically by engaging several other tribal departments. The result of this collaboration has been an integrated road map to building their local workforce.

“I am super proud of my team for taking on those tasks and wearing different hats,” says Eric.

Changing Perspectives

Another challenge that Eric is consistently navigating at SWHA is the astronomically high demand for low-income rental housing. Eric has spearheaded the development of a revolutionary, data-driven program to alleviate that demand by creating pathways to affordable homeownership. Based on income brackets, the program has placed 20 previous renters into new lease-to-own units. Through the leasing period, tenants will be investing into a tangible asset and building skills to successfully take on homeownership.

“We have the entry points for housing options, but this is an exit plan based on self-sufficiency,” proclaims Eric.

The program, currently in its first year, is changing the community’s perspectives surrounding tribal housing. This new view embraces low-income rental units as transition points, rather than permanent dwellings. By moving tenants through low-income units, versus into them, SWHA will be able to lower demand for tribal housing to a more manageable pace while creating opportunities for economic advancement for everyone.

In another step outside of the traditional housing authority box, Eric and his team are creating a handful of Limited Liability Companies (LLCs). One of these entities will include the renovation of an existing hotel to capture more tourism dollars flowing through the state. The idea behind these for-profit entities is to generate income that will support SWHA’s self-sufficiency and decrease reliance on the federal government.

“We’re changing the perspective of what ‘housing authority’ means,” he explains.

Leaving a Legacy

As a champion fancy dancer, competing in almost every state across the country, Eric has seen a lot of Indian Country. From the time he was a young boy, Eric remembers his elders impressing upon him that he was a descendant of strong tribal leaders and that he should carry his heritage in a proud way. Eric knew that his great, great grandfather was one of the first chairmen of the Sisseton Wahpeton Oyate and that other relatives had served in various tribal leadership capacities. But, he grew up in an urban area of Southern California and didn’t fully grasp the meaning of those lessons from his elders until later in life when he moved home to the Lake Traverse Reservation.

This broad range of varied experiences have shaped his unique perspectives and approaches to his work today. As a father of six, he takes a longer view. He isn’t just fulfilling immediate needs for shelter, but he is also developing housing for future generations. His belief that everyone should be able to grow up in a safe and affordable home is a driving force that keeps him going every day. It was also part of what inspired him to become part of the Coalition. He wanted to be a voice for the region and to reach tribal communities across the nation so they could also leave a legacy of homeownership.

His foundational message, “You can do a lot more with your housing authority. It’s doesn’t have to be just what we’ve always done.”

Coalition Names Housing Development Director

The South Dakota Native Homeownership Coalition is pleased to announce that we have selected Red Dawn Foster (Oglala Lakota and Navajo) as Executive Director to lead the formation and launch of our housing development subsidiary, an entity that will support tribal communities in their efforts to increase the number of safe and affordable homes.

“Housing is the foundation to economic development and overall health and wellness of families,” says Foster. “I’m excited to be part of helping Native communities to leverage resources and find innovative solutions.”

Foster is in her third term as a South Dakota State Senator representing the 27th district. She brings over 15 years of experience working with tribal communities in the community and economic development field. Foster holds a Bachelor of Arts degree in Political Science and Master of Arts degree in Business Administration.

“We are thrilled to have Red Dawn on board. This is a milestone in the formation of the Coalition’s housing development subsidiary and a critical step to increasing our overall sustainability and furthering our mission,” says Sharon Vogel, Board Chairwoman of the Coalition.

This strategic staffing step follows the release of a feasibility study that revealed the Coalition could in fact establish a viable development subsidiary. Once the entity is formally established, Foster will design a menu of services that could include assessments, project planning, community engagement, contract management, project management, or other services to meet client needs. She will also create a pool of talented housing development experts to consult with tribes, tribal departments, tribally-designated housing entities, or nonprofit organizations on housing development projects.

The creation of the Coalition’s housing development subsidiary has been supported by the U.S. Department of Health and Human Services – Administration for Native Americans, Enterprise Community Partners, and Wells Fargo InvestNative.