Coalition Programs Expand Career Opportunities

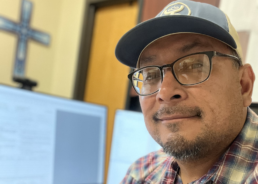

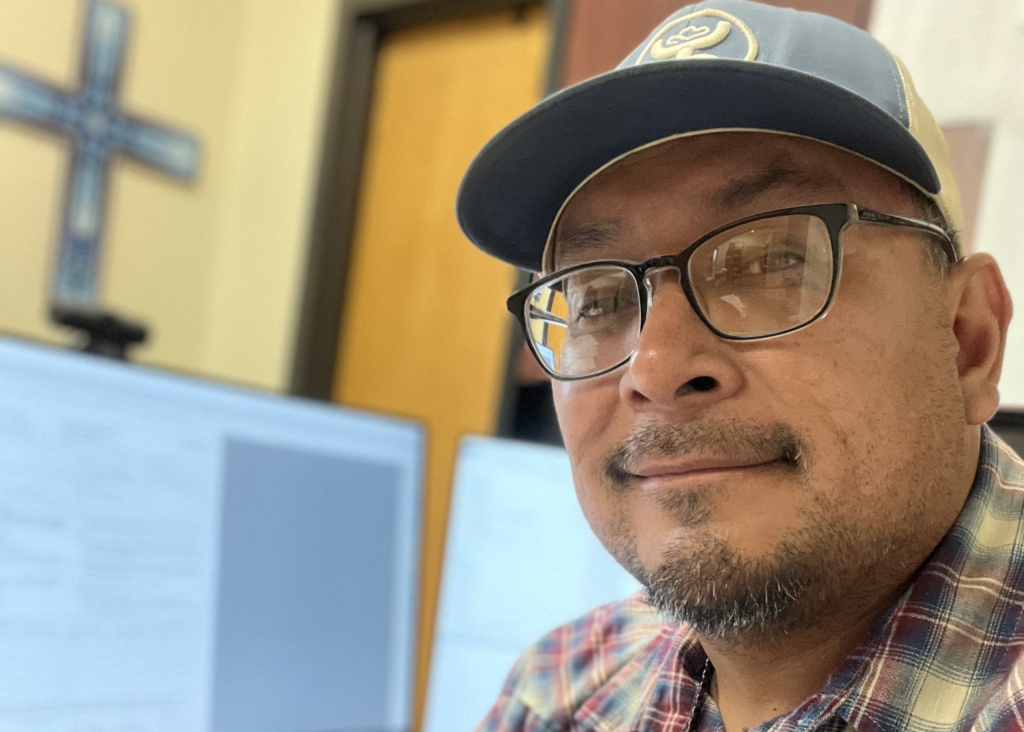

Five years ago, David Spider (Sisseton Wahpeton Oyate) attended one of the South Dakota Native Homeownership Coalition’s first inspector certification trainings. During this training he was introduced to the International Code Council building requirements. After completing a couple more trainings, he successfully passed the 60-question test within the allotted three-hour time limit and became a certified residential building inspector. An employee of the Sisseton Wahpeton Housing Authority, David’s certification immediately and directly benefited his tribal community.

“Since then, I have been able to inspect new housing projects, and we’ve had 57 homes completed over the last five years,” says David.

By having a local certified inspector, construction projects are able to be completed at a faster pace and with the assurance that the structures are safe and durable. A certified inspection is a requirement put in place by many lenders that finance the construction or purchase of residential homes. David says a lot of the inspections he does are for HUD 184 construction loans. He also does inspections for existing homes purchased by tribal members or any homes purchased with the new Sisseton Wahpeton Oyate Down Payment Assistance Program.

In addition, David’s certification has opened more funding opportunities for his tribe’s housing projects. Having that additional qualification on their team makes their grant proposals more competitive.

“We are able to get almost perfect scores in the administrative category on our HUD grants due to the capacity of our team,” says David.

While the inspector certification exam is certainly challenging, David believes his engineering background and bachelor’s degree in civil engineering helped a lot. Because it is an open book test, the key is being able to flip through the book quickly. A solid understanding of the basic concepts and the ability to find topics through the table of contents and index is also a must.

David’s next career enhancing endeavor is becoming a certified general appraiser. Also part of the Coalition’s programming, the appraiser initiative aims to increase the number of appraisers that serve tribal communities throughout the state. So far, David has completed a beginning class and is planning to take several more. Once the class level is complete, he will apprentice with a certified appraiser for 1,800 hours. During that time, he will learn more and more about the job until he is ready to do it on his own. Eventually, he will achieve his own certification.

“I’ll gradually work up to becoming independent within three to five years,” says David.

Coalition Builds Workforce and Improves Home Construction

Since 2016, the South Dakota Native Homeownership Coalition’s Physical Issues Committee has been working to increase the number of certified building instructors in the state’s reservation communities. Building inspectors play a critical role in ensuring homes are safe and healthy for new homeowners. As part of these efforts, the Coalition hosts annual inspector certification workshops that provide attendees with code books, professional training, study materials, and the required fees to take the International Code Council (ICC) certification exam. So far, six individuals have passed the challenge and become certified inspectors for new residential construction.

Archie Marshall, a lead inspector for the Rosebud Sioux Tribe, attended a workshop and passed the test about a year ago. He heard about the workshop from another Coalition member and thought it would be a good opportunity since he was already doing some inspection work.

“I never knew this type of training existed. I was aware of a lot of the codes already, but I had never seen an ICC book,” says Marshall.

He says that even with 35 years of construction experience, he still learned a lot from the workshop and had to work hard to pass the 60-question certification exam within the designated two hours.

“The instructor was really helpful. We learned how to use our code books as a resource guide,” says Marshall.

Once Marshall passed the test, he received a certificate and an identification card from ICC. His certification will be good for three years. Within that time, he must complete a certain amount of Continuing Education Units (CEUs) to stay current on the ever-changing construction industry. Without the CEUs, he’ll have to retake the test.

“I was always told that construction is an evolving industry. Anybody building anything has to have ongoing training,” says Marshall.

Immediately following his certification, he was contracted as the Lead Inspector for the Rosebud Sioux Tribe’s ARPA (American Rescue Plan Act) Construction Office. Since then, he has completed over 150 inspections for remodeled roofs, windows, ADA ramps, door replacements, and more. Amid all of this, he has received several employment opportunities, and he knows of a handful of openings for inspectors.

“So yeah, I have job security,” affirms Marshall.

This year, the Coalition will host two inspector certification workshops – one in March and another in September. These events are being facilitated as part of a $5 million grant from the Economic Development Administration’s (EDA’s) Good Jobs Challenge. Through grant activities, the Coalition and our partners will create 100 jobs over three years.

Workshop Attracts Over 100 Attendees in Effort to Increase Housing Stock on Indian Reservations

Workshop Attracts Over 100 Attendees in Effort to Increase Housing Stock on Indian Reservations

According to the U.S. Department of Housing and Urban Development (HUD), about 16 percent of households on Indian reservations are overcrowded, and an additional 68,000 housing units are needed to alleviate this burden. Housing in Indian Country is a complex and costly problem, but the South Dakota Native Homeownership Coalition is making strides in reversing long-standing issues in our state.

“The Coalition is literally taking a ground-up approach to solving the housing crisis that South Dakota’s reservation communities have been enduring for too long. We’ve taken a proactive approach to eliminate barriers to homeownership. Ultimately, it is about increasing the number of homes so that people have safe and affordable places to live,” says Elias Mendoza, Program Director for the Coalition.

As part of these efforts, the Coalition hosts an annual Contractor’s Workshop designed to build the capacity of construction firms that are working or want to work in Native communities. This year’s workshop attracted 109 attendees from four different states (South Dakota, North Dakota, Montana, and Nebraska) who learned about safety, bonding, financing, and best business practices. They also discussed the possibility of starting a Native American chapter of the International Code Council and had the opportunity to pitch their businesses to various federal, state, and tribal agencies.

“This has become an annual event that building contractors working in reservation communities have come to look forward to. Our hope is that they walk away with tools that will contribute to their success,” says Ellen White Thunder, Deputy Director of Lakota Funds, who played a key role in organizing this year’s event.

The Coalition’s holistic approach to increasing housing stock in reservation communities, which has been underway for nearly six years, also includes a construction internship program, an inspector certification program, and an effort to increase the number of appraisers serving Native communities.

Coalition Convenes Native American Contractors in Effort to Increase Reservation Housing Stock

According to the U.S. Department of Housing and Urban Development (HUD), about 16 percent of households on Indian reservations are overcrowded, and an additional 68,000 housing units are needed to alleviate this burden. Housing in Indian Country is a complex and costly problem, but we are taking a grass roots approach to reverse long-standing issues on our state’s reservations.

“A couple years ago, we convened building contractors that were doing work on reservations and asked them about the major challenges they were facing. Since then, we’ve been implementing multi-faceted solutions designed to build the capacity of Native American building contractors, strengthen the construction industry on our state’s nine reservations, and to ultimately increase the housing stock available to Native American families,” says Tawney Brunsch, a member of the Coalition’s Executive Committee.

This year, at our 3rd annual Contractor’s Workshop the 84 attendees learned about federal and state programs that could put them at an advantage in the marketplace and grow their business. They also discussed the possibility of starting a Native American chapter of the South Dakota Homebuilders Association, which would unify their industry and provide opportunities for peer learning.

Daniel Kirk from Sisseton, South Dakota, started his company, Arrow Construction, a couple of years ago and now has four employees. He said he came to the workshop because he wants to improve the standard of living for his people.

“It’s been awesome to meet up with other contractors – talking about maybe teaming up instead of fighting,” said Kirk.

Kirk and the other building contractors at the workshop received professional instruction and assistance in developing a capability statement, a standard industry tool that is used to market construction firms. At the end of the workshop, they had the opportunity to pitch their firms to several different agencies seeking residential building contractors for upcoming projects.

“Meeting people here will have a big benefit with how I do business,” said Kirk. He believes the connections he made at the workshop are the most valuable thing he will bring back home with him.

Kirk first became involved with the Coalition through our Construction Internship Program last summer. He managed five interns who completed 400 hours of on-site work experience as well as a series of financial literacy trainings.

“The financial literacy was really cool. It changed everyone’s spending habits a little bit,” says Kirk.

During this year’s workshop, Kirk and two of his employees who were interns this summer were recognized along with others who also completed the Construction Internship Program.

“Building a qualified workforce and strengthening the Native American construction industry are foundational steps to making sure there is adequate housing and homeownership opportunities on reservations. We know this will be a long-term effort, but we are pleased with the progress we’ve made in the few short years we’ve been chipping away at some of these challenges,” says Brunsch.

Eighth Renter Transitions to Homeowner in Eagle Nest Housing Development

In the midst of an extreme housing shortage, it is estimated that the Pine Ridge Reservation needs an additional 4,000 homes to provide adequate housing for residents. With a virtually nonexistent residential real estate market, families are commonly on the waiting list for low-income tribal housing for two-plus years. In the meantime, they are “doubling up” or even “tripling up” – terms used to describe multiple families living in a single-family residence – so that their basic needs for shelter are met. As a situation that has spanned several generations, this has become a way of life on the Reservation.

“A lot of people don’t know anything about homeownership or mortgages. We hear about homeowners in the city, but not here,” explains Carrie Sitting Up who rented a home in the Eagle Nest Housing Development, located in the northeast corner of the Reservation.

However, that is beginning to change. As the first Native American Low-Income Housing Tax Credit (LIHTC) project in the country, Eagle Nest has provided affordable rental housing through its 30 single-family units since 1999. When the tax credit agreements reached maturity a few years ago, Lakota Funds, a nonprofit organization who developed the housing track and also a member of the Coalition, began converting the rental units into privately-owned homes.

Since then, they have been working with tenants to prepare them for homeownership by providing financial coaching, homebuyer readiness training, and other resources. During the Coalition’s 2017 Tour & Convening, we visited Eagle Nest and saw first-hand the progress they were making. The first sale in Eagle Nest closed in late 2017, and to date eight homes have sold!

Seeing another tenant become a homeowner inspired Sitting Up. She says, “I liked the outcome of her home. I didn’t think it was possible until I talked to her about it, and it gave me some motivation.”

Sitting Up’s homeownership journey began with getting her finances in order. She says this took some time, because she needed to clear up some debt. But, she was able to utilize Lakota Fund’s Credit Builder Loan to help her with this step.

“It was a beautiful experience, because I was able to figure out my finances on my own and take care of myself,” says Sitting Up.

She was moving through the loan application process with Mazaska Owecaso Otipi Financial, a community loan fund in Pine Ridge and also a Coalition member, when her father passed away in September 2018. After a time of grieving, she says she gathered herself together and sealed the deal.

She reflects on her loan signing, “I really cried, because my dad would have been so proud of me.”

As the first in her family to become a homeowner, Sitting Up says, “I feel like I won a grand prize buying this home.”

Sitting Up rolled several improvements – new windows, doors, siding, and roof – into the purchase of her home. There were other minor repairs, but she wanted to fix those on her own so she could experience the real meaning of homeownership. That is a decision that also kept her mortgage payment, which is comparable to her rental payment, more affordable.

“I’m still learning. Owning a home is a big deal, and I have experienced a bit of a struggle. But I knew I had to do it, because it was important to me,” says Sitting Up. Although it wasn’t easy, she says homeownership has given her structure in her life and it has been a positive step.

Sitting Up is planning a house warming party to celebrate her one-year anniversary of homeownership this Fall. She hopes her story will inspire other people to achieve homeownership.

“I love my home, and I’m really happy living here,” she says.

Construction Internship Program Prepares Tribal Members for Employment Opportunities

After piloting our Construction Internship Program in the Summer of 2017 on the Cheyenne River and Pine Ridge Reservations, the South Dakota Native Homeownership Coalition continued to work with partner organizations in these tribal communities to build on the successful pilot and solidify and strengthen the program during the Summer of 2018.

During our second year, the Coalition worked with more contractors and interns, and a significantly higher percentage of interns completed the program. In 2017, 23 students started the program, with 11 students completing (48%). In 2018, 33 students began the program, with 26 students completing (78%). The 2018 program outcomes were compiled into a report that also includes intern success stories.

In planning for the future, the Coalition plans to focus on the following:

Continue to offer internship on Cheyenne River and Pine Ridge.

The Coalition has developed strong partnerships on Cheyenne River and Pine Ridge, with a core of participating contractors in each community. Looking to the future, the Coalitions plans to continue to offer the internship in these communities.

Expand to additional tribal communities in South Dakota.

A number of additional tribes have expressed interest in the internship, and the Coalition plans to reach out to potential sites and identify new sites by early 2019.

Pilot an administrative/financial management internship.

This internship could build the capacity of contractors, while providing valuable experience for business and financial management students.

Coalition Working on Multiple Fronts to Support Native Construction Industry

Recognizing that the lack of housing stock is a real barrier to homeownership in Native communities, the Coalition is working hard to support local contractors and encourage them to build more homes. We are excited about developing the following programming to support our Native construction industry:

Construction Internship Pilot Program – Summer 2017

After hearing from contractors that finding employment-ready workers is a challenge, in summer 2017, the Coalition launched a pilot internship program to place building trades students from Oglala Lakota College with local contractors. Through the program, students on the Pine Ridge and Cheyenne River Reservations gained valuable hands-on construction experience, while contractors had the chance to test out potential employees in a risk-free setting. The program was managed by our Native CDFI partners – Four Bands Community Fund on Cheyenne River and Lakota Funds on Pine Ridge – who also provided financial education classes to participants. Based on input from interns, contractors, and partners, the program was a huge success; of the 11 students who completed the internship, 9 received job offers from their contractors.

Building on this success, we plan to expand to additional tribal communities in summer 2018. To learn more about the construction internship program, click below to download your copy of the program report.

Contractor Workshop – Jan 31, 2018 – Rapid City

In January 2018, the Coalition’s Veterans Committee organized a one-day workshop for contractors focused on how to work with loan products available for building on trust land. With over 65 participants and contractors from around the state, the workshop was very well attended, and feedback was overwhelmingly positive.

According to one contractor:

“It was a great turnout. A lot of beneficial information provided and networking.”

The day’s agenda included contractor and lender perspectives on working with the HUD 184 loan, information on the VA’s Native American Direct Loan (NADL) and USDA’s 502 loan, resources provided by Native CDFIs, and recognition of the summer 2017 interns and contractors.

Inspector Certification Training – February 27-March 2, 2018 – Rapid City

Understanding that the shortage of certified building inspectors can delay the construction process, the Coalition is also working to increase the number of certified inspectors working in tribal communities. Our goal is to have at least one certified inspector on each reservation in South Dakota. This winter, we held an intensive four-day training to prepare participants for the inspector certification exam, with the actual exam administered on the fourth day of the training. Thirty-one participants attended the training, a combination of independent contractors and housing authority staff. The training was conducted by the International Code Council (ICC), who sent their top instructors to work with our Coalition participants. Feedback about the training was extremely positive; in the words of one participant, “the training was extremely helpful and I appreciate the opportunity to participate.” Another participant stated, “I liked the training – best one I have been at.” Recognizing the value of building codes in providing safety standards, a number of participants have requested support to promote the adoption of building codes in their tribal communities.

Family Celebrates Homeownership this Holiday Season

During the Coalition’s annual site visit this past summer, we learned about the Eagle Nest Housing Development on the Pine Ridge Reservation and how some of our stakeholders were creating homeownership opportunities there. We are pleased to share this story about the first family in the development that has transitioned from renting to homeownership.

This holiday season, Cynthia Plenty Bull and her daughter will be celebrating in the same house they have lived in for the past six years. But this year, they will call the home their own. Cynthia is the first tenant in the 30-unit Eagle Nest Housing Development, originally built in 1997 as low-income rental housing, to make the move to homeownership.

For Cynthia, owning her own home means stability. This is especially critical on the Pine Ridge Reservation, an area with an extreme housing shortage where it is estimated that an additional 4,000 homes are needed to provide adequate housing for residents.

“When you are a homeowner, you don’t have to wonder when it will end or if your lease is going to increase and you won’t be able to afford it anymore,” Cynthia says.

When it was constructed, Eagle Nest Housing Development made history as the first Native American low-income housing tax credit development in America, and since then has provided families with affordable housing. The project was designed as a rent-to-own development, where families would have the option to purchase their homes. As the tax credit agreements have reached maturity, Lakota Funds, who owns the development and also an active Coalition member, is reaching out to current tenants and supporting those interested in transitioning from renting to homeownership.

“Although Lakota Funds has invested a lot into Eagle Nest over the last 19 years, our goal was never to turn a profit. It has always been about creating homeownership opportunities, and our board approved a sale price of the homes to make it affordable for the families in the area,” says Tawney Brunsch, the Executive Director of Lakota Funds.

Cynthia began her homeownership journey this summer by contacting Lakota Funds. Lakota Funds then referred Cynthia to Mazaska Owecaso Otipi Financial, a nonprofit loan fund that provides home loan products and also a Coalition member.

Cynthia comments, “They [Mazaska] would tell me step-by-step what to do. We sat down and they talked to us through the whole process. It wasn’t a scary thing.”

Working between the two partner organizations and her bank over the next five months, Cynthia was connected to all of the resources and capital she needed to reach her homeownership goals. Mazaska and Lakota Funds helped her with financial projections and budgeting to ensure the home purchase would be affordable. She worked with her bank to consolidate debt and lower monthly credit card payments. Cynthia also completed Mazaska’s homebuyer readiness course so she would know what to expect as a homeowner.

The nonprofits helped her identify a local contractor to plan out and estimate several renovations that she would roll into her mortgage loan. Mazaska was also instrumental in helping her access all of the subsidies she qualified for to offset down payment and closing costs, and make the home purchase more affordable. In addition, Mazaska provided the mortgage for Cynthia’s home purchase.

Cynthia closed her loan in October with zero down payment and closing costs, and her monthly payment on her 20-year mortgage is about the same as her rent payments were. Overall, she couldn’t have asked for a smoother transition from renting to owning. Cynthia now owns a 3-bedroom, 2-bathroom home with a new roof and windows, remodeled bathrooms, new flooring and paint, and many more upgrades.

She says that what she likes best about her new home is, “Everything is brand new to me, and everything is the way I like I it.”

Cynthia explains that her daughter, Tia, was instrumental in the renovations. They chose all of the materials together, and Tia provided input and some great ideas throughout the process.

“It was a really good experience for Tia, because when she grows up and wants to purchase another house she will know the steps,” says Cynthia.

In the meantime, Lakota Funds and Mazaska are helping more Eagle Nest families through the same home buying process. They anticipate that one more home loan will close by the end of the year and more will close in early 2018.

“It’s really exciting to see the momentum that Cynthia’s home purchase is creating. Now more families are inspired to go for homeownership,” says Tawney.

Traveling a Path to Self-Sufficiency

January Mathis Works Toward Homeownership

After a nearly five-year journey, January Mathis, a member of the Oglala Sioux Tribe, will soon be moving into a home she can call her own. January’s home is currently one of seven under construction in Thunder Valley Community Development Corporation’s regenerative community just outside of Porcupine, South Dakota, on the Pine Ridge Reservation. When complete, the community will feature 21 energy efficient homes and meet critical housing needs for local families.

With an estimated 4,000 additional units needed to provide adequate housing for the families on the Pine Ridge Reservation, the development will only slightly alleviate the housing shortage on the Reservation. However, nonprofit organizations like Thunder Valley and Lakota Funds are key players in creating models and providing solutions.

Both organizations are active participants in the South Dakota Native Homeownership Coalition, and are just a few of the many stakeholders that are forming collaborative partnerships to increase homeownership opportunities for Native Americans throughout the state. In January’s case, both Lakota Funds and Thunder Valley are providing critical pieces of the puzzle to make homeownership possible.

January began her homeownership journey in 2012 when she started working with Lakota Funds. She started out by utilizing a Credit Builder Loan to pay off debt and improve her credit score. During this time, she completed various trainings offered by Lakota Funds and built her financial skills so she could successfully create and stick to a budget and responsibly use credit.

In the summer of 2015, January enrolled in Lakota Funds’ Individual Development Account (IDA) program to start saving for a down payment on a home. She began making regular deposits into her savings account at the Lakota Federal Credit Union. For every dollar she deposited, Lakota Funds provided a $3 match. While she was saving, January completed a homeownership preparedness course offered by Thunder Valley. Thunder Valley also helped her through the USDA home loan application process.

By the end of 2016, January had deposited $1,440 into her IDA, and Lakota Funds provided a match of $4,320. When she signed the papers for her new home, January was able to put $5,760 down!

Due to limited options, January currently lives in low-income rental housing in Pine Ridge, South Dakota, about an hour’s drive away from her place of employment—the Pine Ridge Area Chamber of Commerce in Kyle. She is excited that her new home will only be a 10-15 minute drive to work. But homeownership means more to her than that.

“When I think of my own home, the first thing I think of is freedom,” she says. It also means stability, she adds. January explains that she moved quite a bit when her kids were younger, but this home will always be “a place for my kids to call their own.”

Coalition Responds to Contractors’ Input

In roundtable discussions with contractors about how to increase housing stock on South Dakota’s reservations, contractors have shared some of the obstacles to residential building, including the lack of inspectors and work-ready employees. In response, our Physical Issues Committee is working to support efforts to increase the number of certified inspectors, and designing a summer internship program for building trades students at Oglala Lakota College to work directly with contractors.

In January, the Coalition held a two-day training to support contractors, TDHE staff, and other nonprofit housing staff in preparing for the inspector certification exam. Thirty seven participants completed this training, and will be taking the certification exam. We wish them luck!

Through the construction internship pilot program, up to twenty students from Oglala Lakota College will spend ten weeks this summer working directly with contractors on the Pine Ridge and Cheyenne River Reservations. The internship will provide the opportunity for students to develop relationships with contractors (leading to potential employment in the future), and gain hands-on work experience. The program will also incorporate financial education and workforce readiness training for students.