Nearly 12,000 People Reached Through “Native Homeownership is Possible” Campaign

On November 5, 2018 the South Dakota Native Homeownership Coalition launched a week-long social media campaign designed to spread the message that “Native Homeownership is Possible” throughout Native communities in the state by utilizing the series of Native homeownership videos we produced. To help our stakeholders engage in the campaign, we developed a Social Media Toolkit with sample posts, a collection of shareable images, and hashtags.

We are pleased to announce that the campaign was incredibly successful! It gained momentum each day, and our message reached far and wide. Here’s what we accomplished:

- Reached 11,869 people through Facebook posts.

- Engaged 519 people through Facebook posts.

- Drove 58 people to the nativehomeownership.com site to seek out homeownership resources or watch additional videos.

- Accumulated 453 views of the videos in the “Native Homeownership is Possible” series.

And some more great news… The content we published during the campaign will continue to have an impact in Native communities. As a result of the campaign, we seeded the idea of homeownership in nearly 12,000 minds. Not all of those people will act right away, but 58 people did take the first step on their homeownership journey by seeking out more information on our nativehomeownership.com website. We can’t wait to see more and more Native families becoming homeowners!

Campaign Participants

The campaign was made possible by our stakeholders that mobilized to help spread the critical message that homeownership is possible in Native communities. We’d like to thank the following people and organizations for sharing and posting content to support a broader reach of the campaign’s messaging:

Juel Burnette

Chance Renville

CRHA Homebuyer Readiness

Andrew Boyd

Lisa Whitewing

Tony Wood

Dowell Caselli Smith

Northwest Area Foundation

GROW South Dakota

Enterprise Community Partners

Lakota Funds

Lakota Federal Credit Union

Homes are Possible, Inc.

Christine Sorensen

Ana Catches

Sweet Grass Consulting

Lesa Jarding

Coalition Reflects on Accomplishments and Re-Energizes for Year Ahead

On October 29, the Coalition held our 5th Annual Planning day, which was the day prior to the South Dakota Annual Housing Conference. During the planning day, we continued our tradition of reflecting on the past year, highlighting accomplishments, and planning for the year ahead. The day provided the opportunity for Coalition members to celebrate our work, explore future priorities, and re-energize for the future. The day’s agenda included:

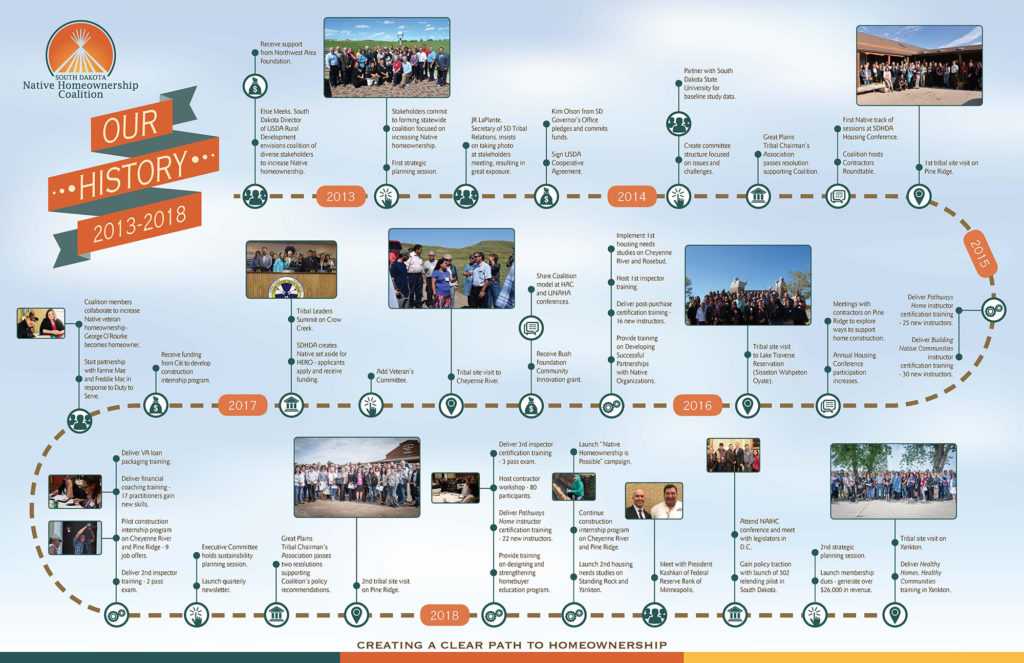

Historical Timeline

Coalition members reviewed this historical timeline, which reflected key milestones in the Coalition’s development. These milestones include annual visits to tribal communities, homebuyer practitioner trainings, launching the construction internship program, the 502 re-lending pilot, and creating the veterans homeownership committee.

Key Accomplishments

Jennifer Irving of Thunder Valley CDC facilitated our look at these accomplishments, including launching the membership drive, developing the Native Homeownership is Possible media campaign, and solidifying the Coalition’s data collection systems.

Strategic Directions

Coalition members had the opportunity to break out into small groups to explore strategic directions proposed by the executive committee:

- Ensuring the Coalition’s sustainability

- Building capacity for Native homeownership

- Identifying outcomes and developing an impact tracking plan

- Developing an effective and comprehensive communication plan

Tribal Leaders Handbook on Homeownership

Jason Adams of the Salish and Kootenai Housing Authority in Montana shared information on the Handbook, which was developed by the Center for Indian Country Development and Enterprise Community Partners.

Housing Needs Studies

Sonny Hill of the Yankton Sioux Tribe and Joanna Donohoe provided an update on the two studies currently being completed with the support of the Coalition and the South Dakota Housing Development Authority. Conducted by Big Water Consulting, the studies are focusing on homeownership needs of the Yankton and Standing Rock Sioux Tribes.

Construction Internship Program

Coalition members had the opportunity learn about 2018 construction internship efforts through a discussion with internship partners: Tawney Brunsch (Lakota Funds), Alissa Benoist (Four Bands Community Fund), Kenny Soderlin (Pine Ridge contractor), and Michael Patton (Pine Ridge intern).

Committee Meetings

Through in-person committee meetings, Coalition members had the chance to review their 2018 efforts, start planning 2019 milestones, and appoint (or re-appoint) committee chairs. Proposed 2019 milestones are reflected here. During their meeting, members of the Funding and Finance committee agreed to change the name of this committee to Coalition and Member Sustainability, to reflect their focus on long-term sustainability.

Commitments

At the conclusion of the planning day, Coalition members noted their individual commitments to the Coalition. These included:

- Renew membership and become more active.

- I commit to being a committee co-chair.

- Become paid member.

- Share social media resources with our media lists to promote the Coalition’s work.

- I will remain committed to providing my time and energy to the goals and mission statement of the SDNHOC. My organization will become a member of SDNHOC. Thank you SDNHOC for all you do for the Indian country and native homeownership.

- My commitment is to obtain knowledge and educate myself so I can be more committed in the future coalition.

- Continue to represent my housing authority.

- I am committed to participating in Coalition activities, committee meetings and promoting the work being done here to other partners nationally. Share Native Homeownership is possible campaign!

- To continue ongoing work needed in our communities. Focus on needs for our people.

Native Homeownership Track at the South Dakota Annual Housing Conference

This year, the Coalition also continued our tradition of planning conference workshops focused on issues relating to Native homeownership. These workshops enable our Coalition members, and other conference attendees, to dive deeper into topics impacting our work. This year’s workshops covered:

- Exploring New Mortgage Market Opportunities: The Mortgage Lending Process on Trust Land

- Homeownership Opportunities for Native Families: A Look at Subdivision Development Financing

- Increasing Housing Stock in Native Communities: New Native-owned Construction Companies

- Home Construction Options on Tribal Land

Coalition Launches Statewide Social Media Campaign

The South Dakota Native Homeownership Coalition is pleased to announce the launch of our “Native Homeownership is Possible” social media campaign. Through this campaign we hope to mobilize a force of stakeholders to amplify the message that ‘homeownership is possible’ within Native communities in South Dakota. During campaign week participating organizations will be sharing and posting content through social media outlets to ensure this critical message is being heard by Native families throughout the state.

Native Homeownership is Possible Campaign

November 5 – 9, 2018

Social Media Toolkit

We have developed an easy to follow toolkit that can be used as a guide for your social media efforts as you take part in the “Native Homeownership is Possible” campaign. Please feel free to use or modify the content presented in this toolkit to help us promote a strong message of Native homeownership.

Shareable Images

We have developed several social share cards for you to use with your favorite social media outlet. Just save the images to your computer or device and start sharing!

Amplifying Our Voice

To help us expand our collective effort, please also use the following hashtags in your social media posts:

#NativeHomeownership

#NativeHomeownershipIsPossible

#MyNativePathHome

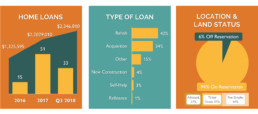

Coalition Reveals Collective Impact Resulting from Three-Year Data Collection Initiative

During the Coalition’s Annual Planning Day, we presented the first data report from our ongoing data collection initiative, which began in 2016 with a desire to show the collective impact our member organizations are having on homeownership rates. Twenty-four organizations that provide homeownership training, assistance, and/or loans participated in the initiative.

The data, which was collected through a variety of methods, reflects loans closed, technical assistance provided, and classroom trainings offered from January 2017 through September 2018 by the participating organizations. The report highlights include:

- 131 home loans totaling $7,064,300 were made to Native American families

- Within those loans, $940,380 was provided in subsidies

- A total of 4,997 hours of technical assistance were provided to 1,702 clients

- 2,872 people attended a total of 488 classroom trainings

Other details included in the report were types of loans, land location and land status, types of lenders/packagers, and percentage of subsidies by type. In addition to this activity data the Coalition has implemented and annual activity report and data collection tool which highlights certified counseling activity, the types of trainings offered, partnerships, sources of subsidies, HERO certification, number of clients in loan pipelines, and the key impacts of participating in the Coalition.

This initial report is a brief preview into some of the data that the Coalition collects and reports on. In the future, more detailed reports will be available.

Welcome Elaine Kennedy!

We are pleased to announce that we have hired a part-time Program Coordinator. Join us in welcoming Elaine Kennedy!

Elaine has a strong background in the Native American community development field, and some of you may have already met her while she was employed with Hunkpati Investments. Elaine will be supporting the Coalition with membership, data collection, and events, so you might be hearing from her soon.

A little more about Elaine…

Elaine Kennedy began working in the Native American community and economic development field in 2012 with Hunkpati Investments, a Native community development financial institution (CDFI) that served the Crow Creek Reservation in South Dakota. During her time with Hunkpati she served in several different capacities, including business coach, loan officer, individual development account (IDA) program support, and the volunteer income tax assistance (VITA) site coordinator. Elaine holds a Bachelor of Arts degree in Political Science, a Bachelor of Science degree in Business Administration, and an Associate of Science degree in Business Administration. In addition, she has obtained several certifications in various training programs and curricula, including Indianpreneurship, Workin’ with Tradition, SBA 8(a) Business Development, Building Native Communities: Financial Skills for Families, Pathways Home, and NeighborWorks Financial Coaching.

Construction Internship Program Prepares Tribal Members for Employment Opportunities

After piloting our Construction Internship Program in the Summer of 2017 on the Cheyenne River and Pine Ridge Reservations, the South Dakota Native Homeownership Coalition continued to work with partner organizations in these tribal communities to build on the successful pilot and solidify and strengthen the program during the Summer of 2018.

During our second year, the Coalition worked with more contractors and interns, and a significantly higher percentage of interns completed the program. In 2017, 23 students started the program, with 11 students completing (48%). In 2018, 33 students began the program, with 26 students completing (78%). The 2018 program outcomes were compiled into a report that also includes intern success stories.

In planning for the future, the Coalition plans to focus on the following:

Continue to offer internship on Cheyenne River and Pine Ridge.

The Coalition has developed strong partnerships on Cheyenne River and Pine Ridge, with a core of participating contractors in each community. Looking to the future, the Coalitions plans to continue to offer the internship in these communities.

Expand to additional tribal communities in South Dakota.

A number of additional tribes have expressed interest in the internship, and the Coalition plans to reach out to potential sites and identify new sites by early 2019.

Pilot an administrative/financial management internship.

This internship could build the capacity of contractors, while providing valuable experience for business and financial management students.

Coalition Celebrates USDA 502 Relending Pilot

The US Department of Agriculture’s Assistant to the Secretary for Rural Development, Anne Hazlett visited the Pine Ridge Reservation to meet with Four Bands Community Fund, Mazaska Owecaso Otipi Financial, and other regional partners to discuss the launch of a pilot program to increase homeownership opportunities on tribal lands. Through the 502 Relending Pilot, USDA Rural Development is partnering with Four Bands and Mazaska, both Native community development financial institutions and active Coalition members, to deploy a total of $2,000,000 to eligible Native American homebuyers located in tribal communities of South Dakota and North Dakota. According to USDA, the CDFIs’ deep ties in local communities will help them to reach homebuyers more effectively than other lenders.

The Coalition is excited to see this new development and has been actively advocating for this model as a solution to increase access to USDA’s home loan programs for Native American families. Our efforts, led by our Policy Committee Co-chairpersons, JC Crawford and Sharon Vogel, have included engaging partners and policy makers in various meetings and briefings over the past four-plus years. By creating alliances and identifying champions, we continued to raise awareness of challenges and opportunities related to homeownership and Native American communities.

We’d like to express our gratitude especially to U.S. Senator John Thune (R-SD), as well as U.S. Senator Mike Rounds (R-SD) and U.S. Representative Kristi Noem (R-SD). The South Dakota delegation requested that USDA implement the pilot and recognized that while the 502 Direct Loan program is highly utilized, only 23 of the 7,187 loans made through the program in fiscal year 2017 went to Native American families on tribal lands. We’d also like to recognize U.S. Senators John Hoeven (D-ND) and Heidi Heitkamp (D-ND) who were instrumental in launching the pilot.

The Coalition will continue working with these legislators and USDA Rural Development as the pilot experiences great success. We anticipate that the 502 Relending Program will expand throughout Indian Country and hope it will be a model for creating greater access to other federal mortgage programs on tribal lands.

Thanks to the US Department of Agriculture for contributing photos of Ms. Hazlett’s visit!

Yankton Sioux Tribe Hosts Coalition’s 5th Annual Tour & Convening

On June 6, 2018, over 50 of our members joined with more than 25 members of the Yankton Sioux Tribe for the Coalition’s 5th Annual Homeownership Tour & Convening. Hosted by the Business and Claims Committee of the Yankton Sioux Tribe, the day opened with a Veterans flag presentation and drum group, and welcome remarks by Tribal Chairman Robert Flying Hawk as well as other members of the Committee.

The convening provided the opportunity to learn about:

- The Tribe’s plans for homeownership

- Preview the Coalition’s new video series showing that “Native Homeownership is Possible”

- Share updates and accomplishments

For many Coalition members, the tour of the Reservation was the highlight of the day. During the tour, David LeCompte, the BIA Deputy Superintendent, pointed out different sites that had been identified for future homeownership development. Many of these sites already have existing infrastructure, including water, wastewater, and access to roads.

According to Tawney Brunsch, Executive Director of Lakota Funds and a Coalition member,

“I was struck by the opportunity for homeownership with all of the land available.”

As part of the day’s agenda, Coalition members also heard directly from homeowners about their experiences and the benefits of homeownership. Tribal Veterans Service Officer Dennis Rucker shared his experience in qualifying for a Native American Direct Loan from the US Department of Veterans Affairs, while Kenny Cook, the Treasurer of the Yankton Sioux Tribe, shared his experience in accessing a 502 Direct Loan through USDA Rural Development.

During reflections at the conclusion of the day, Coalition members recognized the importance of the Tribe’s support.

According to one Coalition member,

“The support we have seen from the Tribe is outstanding. Thank you to Tribal Council for promoting homeownership.”

Green Living Practices

The day following the Tour & Convening, several homeownership practitioners gathered for a training session, “Healthy Homes, Healthy Communities.” Focusing on eco-friendly living practices, the training was born out of recognition of the importance of incorporating healthy living practices into post-purchase counseling. It also took into account how green practices can reduce utilities and maintenance costs associated with homeownership, which is a top priority for low-income communities. Training participants were immersed in lessons on using traditional plants, incorporating efficiency into daily habits, and utilizing nontoxic products for maintenance.

Ana Catches, Homeownership and Housing Initiative Coordinator at Thunder Valley Community Development Corporation, attended the training and said this,

“I was able to learn about traditional plants – how they are used for different remedies for homes and families and for clean air quality in homes. I learned about behavior on how to be a smart homeowner and consumer when making purchases on building products and cleaning supplies, and when building a new house to avoid products with high volumes of VOC.”

Upon completing the training, attendees all agreed that practicing sustainable and green living to create a healthy home environment was well worth the investment as it reduces long-term expenses for homeowners and their communities.

Coalition Partners Join Forces to Make Homeownership Dream a Reality

In early June, Sherry Morgan, an enrolled member of the Crow Creek Sioux Tribe, realized her dream of homeownership with the help and support from several of our Coalition members. She now owns a home located on her parents’ leased land where she lived as a young girl.

In recognizing her great accomplishment, a celebratory event was held at Sherry’s home on June 5, 2018, and attended by several partner organizations, family, and community members. During the event, a Crow Creek elder blessed Sherry’s home, and an honor song was performed by the local drum group Bad Nation. USDA Rural Development Director, Julie Gross, presented Sherry with a certificate, and a meal was shared by all who attended.

During the event, Sherry said,

“The feelings are overwhelming for me as a first-time homeowner. Having this home built on the previous site of where my mom and dad lived makes it bittersweet.”

The innovative way in which Coalition members worked together created a path to homeownership for Sherry. This project is USDA Rural Development’s first 502 New Construction Direct Loan with the South Dakota Housing Development Authority’s Governor’s House Program on the Crow Creek Indian Reservation. USDA Rural Development leveraged the 502 Loan with Federal Home Loan Bank’s Native American Homeownership Initiative (NAHI) program through Dacotah Bank, as well as the Crow Creek Housing Authority to assist Sherry with the purchase of the Governor’s House. She also received funds through the Homes are Possible, Inc. (HAPI) grant program for closing costs.

Although Sherry’s homeownership journey was nearly two years, she was driven and committed through the entire process. She hopes that by sharing her story, it will inspire others to jump in with both feet to obtain homeownership.

Coalition Launches “Native Homeownership is Possible” Campaign

We are pleased to announce that we have launched our “Native Homeownership is Possible” campaign through a new website at www.nativehomeownership.com. The website includes a series of short videos designed to:

- Raise awareness of the concept of homeownership in reservation communities.

- Implore that homeownership is possible for Native Americans.

- Inspire and encourage Native American individuals and families to start on the path to homeownership.

In addition, the website features contacts listed by reservation and off-reservation areas that people can access to start on their path to homeownership.

We encourage all of our stakeholders to share these inspiring videos to help spread the message that “Native Homeownership is Possible.”